Sartorius Stedim Biotech Shares

Facts about the Share1)

| ISIN | FR0013154002 |

| Liquidity provider | Gilbert Dupont |

| Stock exchange | Euronext Paris |

| Market segment | Local Securities – Compartment A (Large Caps) |

| Indexes | SBF 120; CAC All-Tradable, All Shares, Mid 60, Healthcare; STOXX Europe 600; MSCI France |

| Number of shares | 92,180,190 |

thereof Sartorius AG | 74.3% |

thereof free float | 25.7% |

| Voting rights | 160,978,400 |

thereof Sartorius AG | 85.0% |

thereof free float | 15.0% |

1) As of December 31, 2019

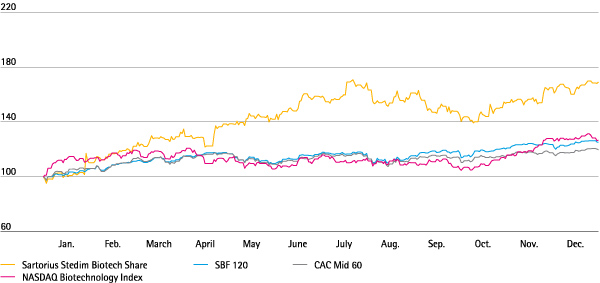

Global Stock Markets Post Price Gains

The world's major stock markets started off 2019 with strong price gains in the first quarter. Despite a weakening global economy and economic policy conflicts, such as the customs and trade disputes between the USA and China, share prices continued to rise further. In particular, interest rate cuts by the U.S. Federal Reserve had a positive impact on stock markets. Supported by expansive monetary policy, the Dow Jones reached a new record high in the reporting year. The leading French stock index CAC 40 also soared in the fourth quarter, approaching its historical high, and closed the year under review at 5,978 points, up 26.4%. The SBF 120 and CAC Mid 60, home to Sartorius Stedim Biotech shares, increased 25.2% and 19.2%, respectively. The index relevant to the biotech industry, NASDAQ Biotechnology, registered a gain of 24.4%.

Sartorius Shares Rise Substantially

The Sartorius Stedim Biotech share price developed positively yet again. Contributing factors included better-than-expected business performance and raised guidance halfway through 2019, as well as the announcement of two acquisitions. Especially in the first half of the year, the shares saw significant gains and reached an all-time high of €149.20 on July 23, 2019. In the following months, the shares depreciated slightly, but recovered again after a strong fourth quarter, closing the 2019 stock-market year at €147.70 – up 69.1% year over year.

Sartorius Stedim Biotech Share in €1)

January 1, 2015, to December 31, 2019

1) January 1, 2015, to May 9, 2017, adjusted for stock split

Sartorius Stedim Biotech Share1) in Comparison to the SBF 120, CAC Mid 60 and NASDAQ Biotechnology Index (indexed)

January 1, 2019, to December 31, 2019

Investor Relations Activities

Sartorius Stedim Biotechs’ investor relations activities follow the objective of making the current and future development of the company transparent for its stakeholders. To achieve this objective, Sartorius maintains an ongoing, open dialog with shareholders, potential investors and financial analysts.

Besides providing quarterly, first-half and annual reports, we inform the capital market and the interested public at quarterly teleconferences and in regularly published press releases about the current development of our business and other material events at the company. Moreover, Group management and our IR team were present for talks and factory tours with capital-market participants at our sites in Aubagne, France, and in Göttingen, Germany. Management and IR specialists also took part at conferences and roadshows in various financial centers.

All information and publications relating to our company and its shares are provided on our website at www.sartorius-stedim.com.

Analysts

The recommendations of financial analysts serve as a foundation for the decisions of private and institutional investors when investing in shares. Currently, eight institutions regularly prepare reports and updates on Sartorius Stedim Biotech shares.

Research Coverage

| Date | Company | Recommendation | Target price in € |

| January 31, 2020 | UBS | Hold | 168.00 |

| January 31, 2020 | Société Générale | Buy | 189.00 |

| January 30, 2020 | J.P. Morgan | Buy | 180.00 |

| January 29, 2020 | Janney | Hold | 165.00 |

| January 28, 2020 | Oddo BHF | Buy | 171.00 |

| October 22, 2019 | Intron Health | Buy | 150.00 |

| September 19, 2019 | AlphaValue | Sell | 121.00 |

| October 23, 2018 | Gilbert Dupont | Sell | 119.00 |

Key Figures for Sartorius Stedim Biotech Share1)

| 2019 | 2018 | 2017 | 2016 | 2015 | ||

| Share price2) in € | Reporting date | 147.70 | 87.35 | 60.29 | 59.97 | 58.90 |

| High | 149.20 | 119.80 | 72.49 | 68.84 | 59.67 | |

| Low | 83.30 | 60.35 | 51.50 | 51.17 | 26.89 | |

| Dividends3) in € | 0.68 | 0.57 | 0.46 | 0.42 | 0.33 | |

| Total dividends paid3) in millions of € | 62.7 | 52.5 | 42.4 | 38.7 | 30.7 | |

| Payout ratio3,4) in % | 23.8 | 24.0 | 23.5 | 21.9 | 22.1 | |

| Dividend yield5) in % | 0.5 | 0.7 | 0.8 | 0.7 | 0.6 | |

| Market capitalization in millions of € | 13,615.0 | 8,051.9 | 5,557.5 | 5,528.0 | 5,430.8 | |

| Average daily trading number of shares | 63,935 | 80,140 | 52,753 | 46,752 | 44,115 | |

| Trading volume of shares in millions of € | 2,037.8 | 1,874.9 | 818.2 | 714.2 | 485.2 | |

| CAC MID & SMALL (closing prices of the year) | 13,494 | 11,337 | 14,456 | 11,848 | 11,054 | |

| SBF 120 (closing prices of the year) | 4,704 | 3,756 | 4,251 | 3,836 | 3,664 |

1) For 2015, share prices, dividends and average daily trading number of shares adjusted for stock split; rounded values

2) Daily closing price

3) For 2019, amounts suggested by the Board of Directors and subject to approval by the Annual General Shareholders' Meeting

4) Based on the underlying net result

5) Dividends in relation to the corresponding closing prices of the year

Sources: Euronext; Bloomberg

Dividends

Sartorius Stedim Biotech strives to enable its shareholders to participate adequately in the company’s success and has continuously increased its dividend in recent years. In line with this objective, we basically follow the policy of paying out a relatively stable share of relevant net profit to our shareholders.

Relevant Net Profit

The Board of Directors will submit a proposal to the Annual General Shareholders' Meeting on March 24, 2020, to pay a dividend of €0.68 per share from the underlying net profit of €262.9 million for fiscal 2019, up from the previous year’s figure of €0.57. If approved, the dividend would increase for the eleventh consecutive year, and the total profit distributed would rise by a considerable 19.3%, from €52.5million the previous year to €62.7million. The corresponding dividend payout ratio would be 23.8% compared with 24.0% in the previous year. In relation to the shares' closing price of €147.70 on December 31, 2019, the dividend yield would be 0.5% (previous year: 0.7%).

Shareholder Structure

As a consequence of the stock split and the increase in the individual par value of the company's shares, Stedim Biotech S.A.’s issued capital amounted to €18.4million as of December 31, 2019, and was divided into 92,180,190 shares, each with a calculated par value of €0.20. As some of the shares confer double voting rights, there were 160,978,400 voting rights total as of the reporting date.

As of December 31, 2019, Sartorius AG has held 74.3% of the Stedim Biotech S.A.'s share capital and 85.0% of the voting rights outstanding. The remaining 25.7% of Stedim Biotech S.A. shares are in free float, corresponding to 15.0% of the voting rights outstanding.